Bernard Thant graduated as master in Commercial Sciences at EHSAL (now known as Hogeschool-Universiteit Brussel). Afterwards he completed a one-year postgraduate in Finance and Investment Management. After his studies he joined Société Générale Private Banking Belgium (previously Bank De Maertelaere) where he worked for most of his career as a financial analyst. During that time, he also acted as portfolio manager equities at the same company for a number of years. Bernard joined the Econopolis Wealth Management team in September 2014 as an equity analyst.

Home is where the heart is

‘Home is where the heart is’ sung Elvis Presley in the early sixties. What did not change in that roughly 50-year time frame, is that buying a home still remains the most expensive outlay for nearly all people in their entire life. What is different today is that buying a home has never been so difficult in the sense that affordability of homes in the US is at record lows!

Come on and take me for a ride

Shares of most homebuilders are not far from recent record highs. The graph below shows that shares of US homebuilders have been volatile but sound investments over the past decade. Moreover, the year-to-date performance of most homebuilder stocks also leaves investors with a smile. Of the five main listed homebuilders – D.R. Horton, Lennar Corp, PulteGroup, NVR, and Toll Brothers – only one stock is down since the start of the year (D.R. Horton -3.9%). The other stocks show gains ranging from 6.9% to 17%.

Source: Econopolis, LSEG Datastream

More than a feeling?

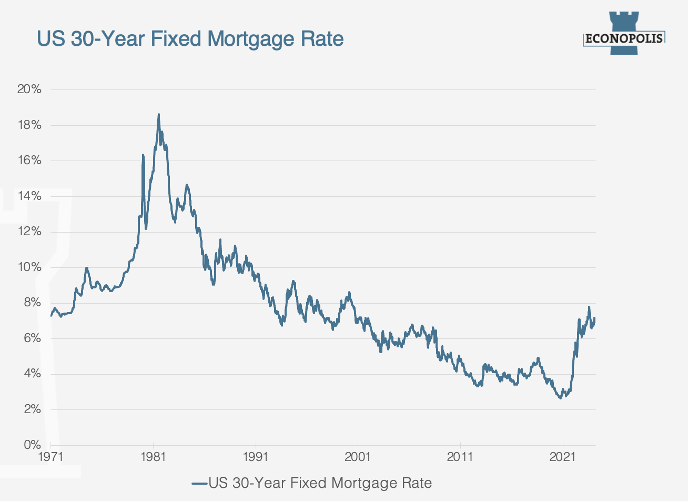

The strong performance of homebuilders is counterintuitive. Is the housing sector not very sensitive to interest rates, and haven’t these gone up a lot? Yes, interest rates are an important factor for the industry since most people must take on a long-term mortgage (typically 30 years in the US) to fund the purchase of a home. And again, yes, mortgage rates have gone up significantly. They have roughly doubled from the 2021 level to around 7%. Although, looking back further in history, the 7% rate doesn’t seem outrageous. We just got spoiled since the turn of the century with interest rates that only went one way—down. The era of ultra-low rates is over since inflation spiraled in the post-COVID era. It remains tough to get inflation back to the desired level (around 2-3%) that central banks are aiming for. This means that rate cuts by the Fed keep getting postponed, and mortgage rates will probably stay higher for longer.

Source: Econopolis, LSEG Datastream

Bye bye discounts, hello full prices

Despite the increased mortgage rates, demand for homes remains strong. Unemployment in the US is at record lows. At the same time, new families are still being formed. The supply of homes remains constrained. Way too few new homes were built over the past decade. In addition, the supply of existing homes is low. It often makes little sense for a homeowner to trade a home financed at a cheap mortgage rate for a new (albeit often larger or newer) home with a much higher mortgage rate.

In the end, all markets are driven by the supply-demand equation. For the homebuilders, this means it is a seller’s market today. There is little reason for homebuilders to offer discounts given strong demand and constrained supply. This, of course, drives the profits and margins of homebuilders upwards.

It ain’t over till the fat lady sings

As a result of the high margins and strong demand, homebuilders are starting to increase supply via higher housing starts. One would think this will spoil the party quickly, but obtaining permits and constructing homes takes time. Additionally, the risk of oversupply is low given a decade of too few new builds. As a result, the party for homebuilders may last longer.

Regulation, what is it good for?

Regulation is necessary to prevent people from building anything anywhere, but overly stringent laws can have adverse effects. One way to help ease the pressure on the US housing market could be to build a large number of smaller (thus more affordable) homes. Unfortunately, regulation, zoning laws, and pushbacks from surrounding inhabitants (NIMBY) function as stumbling blocks, making building smaller homes more expensive and complicated. For homebuilders, there is no strong incentive to build smaller homes as they typically make somewhat lower margins on these. Even if homebuilders want to go for smaller homes, it is often not possible as communities won’t allow plots of land to be divided into small enough pieces.

Inflation = T.N.T.?

The big post-corona inflation wave also hit the building industry. Homebuilders were confronted with strong wage increases and higher prices for timber, bricks, insulation products, and various building materials. Given the strong demand, homebuilders were able to largely pass these costs on to homebuyers in the form of higher prices. As inflation remains stubbornly high, at some point homebuilders may have to absorb some of the price increases themselves, which may weigh somewhat on their profit margins.

It's all about the economy, stupid

The above catchphrase was one of the three key messages that James Carville – a strategist for Bill Clinton’s election campaign – hung up in the Little Rock campaign headquarters. That quote remains impactful and holds a lot of truth. Homebuilding remains a cyclical industry. In a downturn, when people lose their jobs, their last worry is buying a new home. We wouldn’t say it’s all about the economy, but it is an important factor for homebuilders. In the case of homebuilders, we would adjust James Carville’s quote into the following – admittedly much less catchy – phrase: "It’s all about the economy, interest rates, and supply versus demand."