Maxim Gilis obtained a Master in Applied Economics at the University of Antwerp in 2015. His master thesis examined the diversification of stocks in emerging markets. Next he obtained an additional Master of Finance at the Antwerp Management School, where he researched sustainable responsible investing for a European asset management company. He joined Econopolis in the summer of 2016.

In our work at Econopolis, we spend a lot of time thinking about how to construct the best investment portfolios—and these days, a big part of that conversation centers on the role of active and passive styles of investing, an ongoing (and sometimes quite heated!) debate in the financial industry.

This isn’t just an academic conversation: It has the potential to affect your investment results in a real and meaningful way.

What is ‘active investing,’ really?

Active investing means investing in funds whose portfolio managers select investments based on an independent assessment of each investment’s worth—essentially, trying to choose the best investments. Generally speaking, the goal of active managers is to “beat the market,” or outperform certain standard benchmarks. For example, if you’re an active investor, your goal may be to achieve better returns than the MSCI World Index.

What does it mean to be a passive investor?

If you’re a passive investor, you wouldn’t undergo the process of assessing the virtue of any specific investment. Your goal would be to match the performance of certain market indexes rather than trying to outperform them. Passive managers simply seek to own all the stocks in a given market index, in the proportion they are held in that index.

Active vs. Passive: Which is better?

That depends who you ask. While passive investing has grown in popularity over the last few years, Econopolis has found that in many cases active management help investors improve their risk-adjusted returns. We’ve found that active managers can be especially helpful during periods of market stress, when outperformance can be most critical for investors. In fact, over the last 20 years, top-quartile portfolio managers have significantly outperformed their benchmarks in years when the market was down.

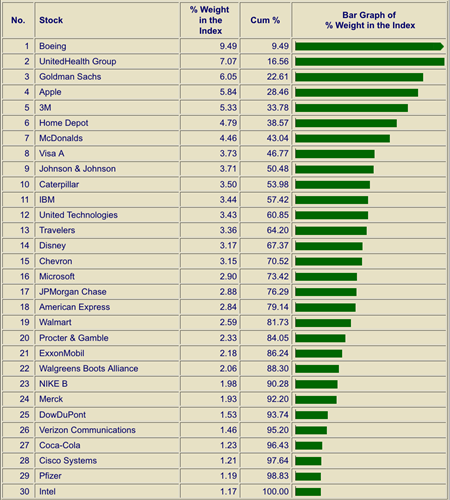

Active investing is more flexible because you are not tied to the composition of a benchmark index. That composition can sometimes be very unbalanced. In the Dow Jones Industrial Average, for example, Boeing alone weighs almost 10%. Through active investing one can diversify its investment portfolio better.

Table: Top 30 Composition of the Dow Jones Industrial Average Index

Growing companies in an earlier stage will only enter a large index if they achieve a large market capitalization (and as a consequance have already performed well). With active investing, one can already invest in such growth companies. In general, active investing offers more options. It allows you to respond to opportunities such as low-cost entry in case of a sharp correction of a specific share. You can also deliberately avoid specific stocks, bonds or other securities. This is why we at Econopolis prefer active over passive investment strategies.

Active and passive management are not always water and fire. After all, passive investing via ETFs or trackers can also be used as an addition to active management, for example to adjust positions very quickly, or to invest in specific markets / market segments (which are sometimes more difficult to access).